When an engine fails, the decision on how to replace it becomes pivotal—especially for automotive OEMs and dealership networks. The available options typically include a new, remanufactured, rebuilt, or used engine.

While these terms are often misunderstood or used interchangeably by consumers, they carry distinct technical and commercial implications within the OEM and dealership environment. The choice directly impacts performance reliability, warranty exposure, customer satisfaction, and total lifecycle cost.

A new engine is self-explanatory: it is a factory-fresh product manufactured to original specifications. However, opting for a new engine is not always the most cost-effective or sustainable choice for either the customer or the OEM.

This article explores the specific attributes that distinguish remanufactured engines—and why they are becoming a cornerstone in modern aftersales strategies and dealership service operations.

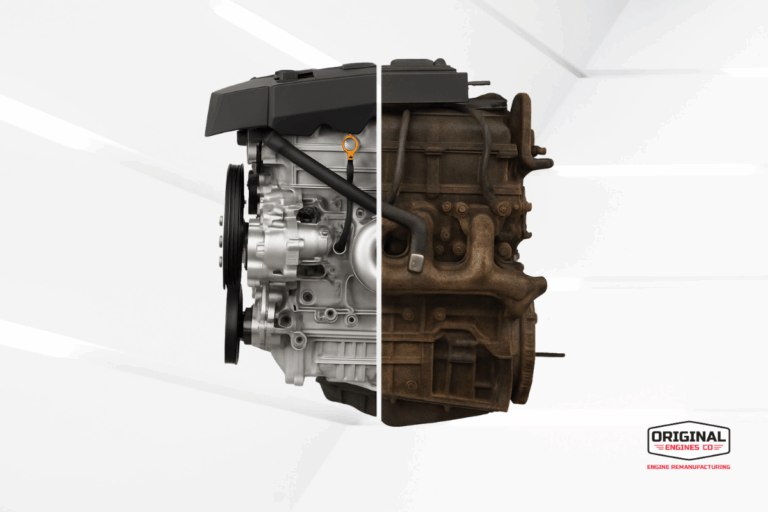

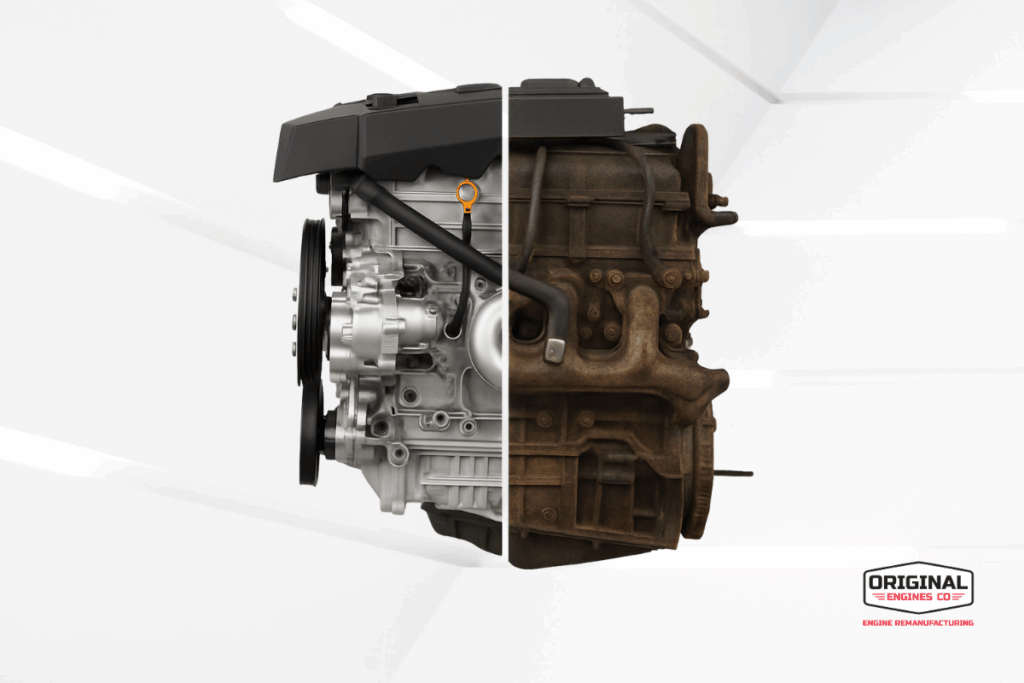

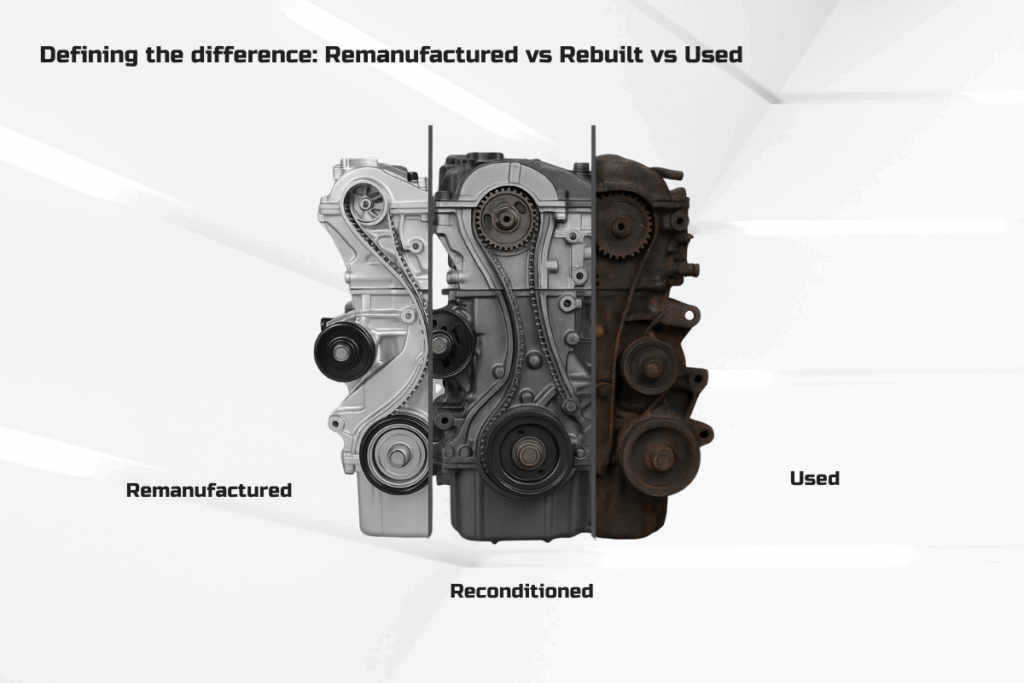

Defining the Differences: Remanufactured vs Rebuilt vs Used

A clear understanding of the differences between used, rebuilt, and remanufactured engines is critical when establishing service policies, managing warranty expectations, or recommending repair solutions. Each type presents distinct risks and benefits for OEMs, dealerships, and end customers.

Used Engines

- Typically sourced from salvage yards or donor vehicles and sold in “as-removed” condition.

- No disassembly, component-level inspection, or testing is performed prior to resale.

- Service history, mileage, and failure modes are often unknown.

- Represent the lowest upfront cost but carry the highest risk of warranty claims, repeat failures, and customer dissatisfaction.

Used engines may have appeal in budget-sensitive repairs but are generally unsuitable for dealership or OEM programs due to high variability in quality and the lack of assurance around performance.

While used engines play a role in the circular economy—often becoming viable core units for rebuilding or remanufacturing—their direct reuse without reprocessing introduces significant reliability risks.

Rebuilt (or Reconditioned) Engines

- Engine is disassembled and cleaned; only visibly worn or failed components are replaced.

- There is no assurance that internal components meet OEM specifications, including dimensional tolerances and performance standards.

- Legacy parts may be reused without addressing known design improvements or service bulletins.

- Overall performance and longevity are inconsistent, relying heavily on individual technician judgment rather than standardised processes.

Rebuilt engines typically appeal to cost-sensitive repair environments and are commonly offered through independent workshops or B2C channels. While they may provide a short-term solution, the lack of standardised validation, specification-based testing, and component traceability leads to higher warranty exposure and unpredictable customer outcomes.

For OEMs and dealership networks, rebuilt engines are rarely the preferred solution. Outside of factory-new replacements, remanufactured engines remain the most strategic choice, offering consistency, validated performance, and alignment with global quality systems.

Remanufactured Engines

- Undergo complete disassembly, rigorous cleaning, and component-level inspection and restoration.

- All critical wear points are re-machined or replaced to meet or exceed original OEM dimensional specifications.

- Failure-prone or superseded components are proactively replaced, including updates referenced in OEM Technical Service Bulletins (TSBs).

- Engines are functionally tested under load conditions (e.g. dynamic rotational load testing) to validate output, durability, and conformance to performance benchmarks.

According to the Automotive Parts Remanufacturers Association (APRA), remanufactured engines deliver performance equivalent to new engines, while supporting circular economy principles through material reuse and precision restoration.

Remanufacturing is typically conducted in ISO-certified facilities using validated, repeatable processes, ensuring traceability, consistency, and quality assurance. For OEMs and dealerships, this translates to:

- Reduced warranty claims

- Higher customer satisfaction

- Improved service confidence and brand integrity

Remanufactured engines represent the most strategic alternative to new engines—combining performance, cost-effectiveness, and sustainability in a package aligned with OEM aftersales frameworks.

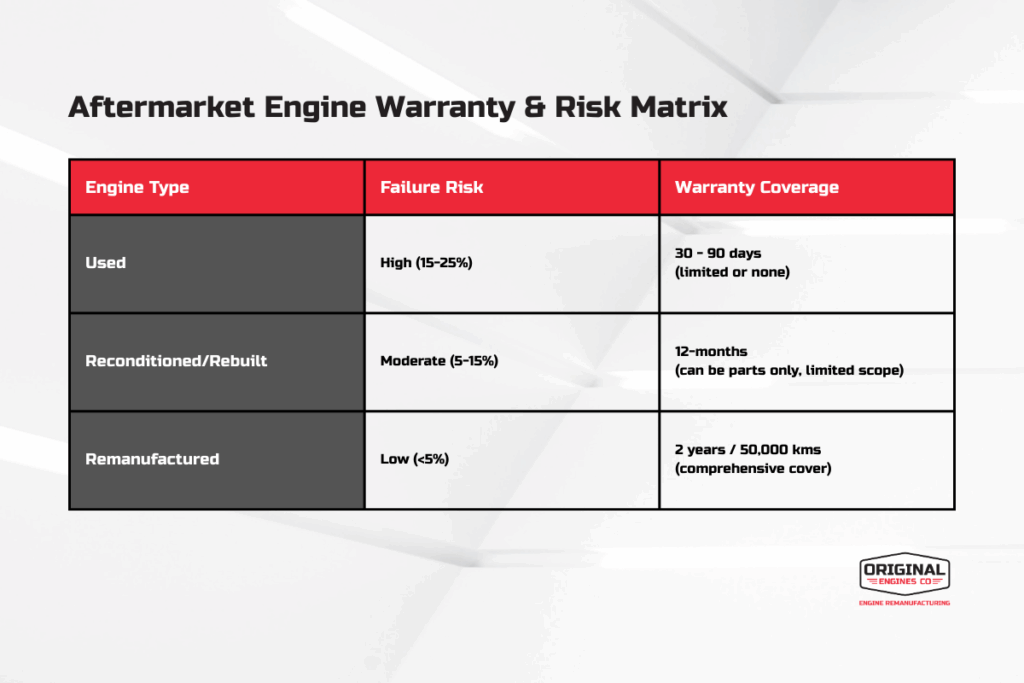

Performance and Warranty Risk Management

Engine failure following installation is a leading contributor to warranty costs and a major disruptor to dealership fixed operations revenue. The type of replacement engine selected has a direct correlation to the likelihood of post-installation failure and the scope of warranty coverage required. Refer to our aftermarket engine warranty and risk matrix below

A 2019 industry analysis by Frost & Sullivan confirmed that remanufactured powertrain assemblies—particularly those produced by OEM-certified or Tier 1 remanufacturers—consistently achieve lower failure rates and higher end-user satisfaction.

Notably, in 2024, Original Engines Co reported a return rate of less than 1%, reinforcing the reliability of structured remanufacturing.

For OEMs and dealerships, lower failure rates directly support:

- Reduced warranty reserve utilization

- Fewer goodwill repair obligations

- Stronger customer retention and satisfaction metric

Remanufactured engines deliver a measurable commercial advantage through enhanced durability and greater lifecycle predictability—factors that are critical in today’s competitive aftersales landscape.

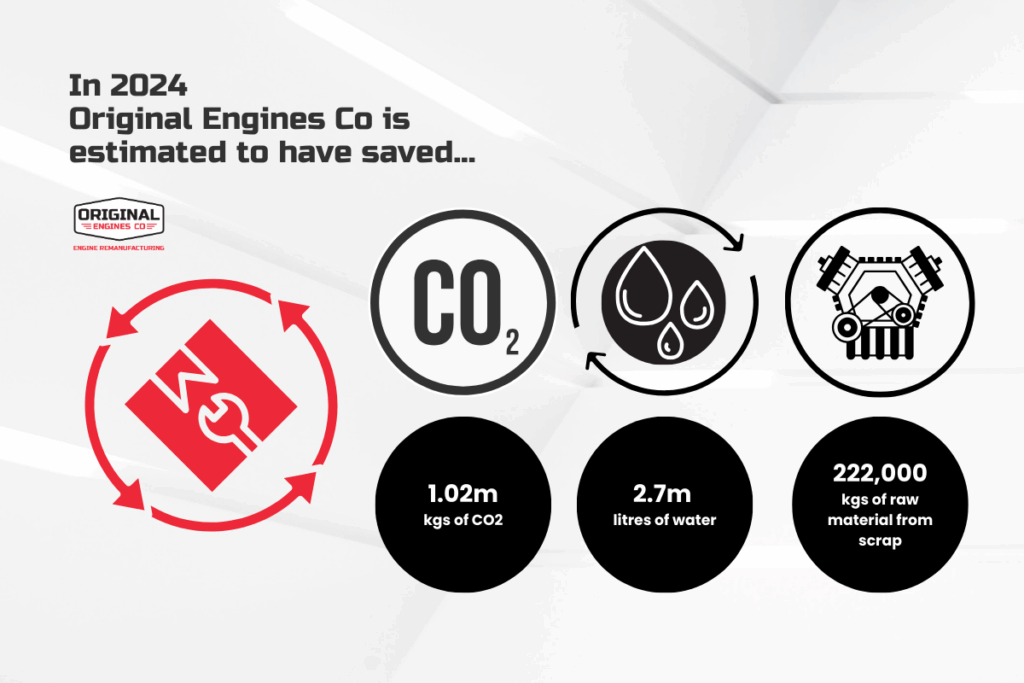

Environmental Compliance and Sustainability Goals

OEMs and Tier 1 suppliers are now under growing scrutiny regarding their Environmental, Social, and Governance (ESG) performance. As global automotive programs align with circular economy principles, remanufactured engines have emerged as a critical enabler of carbon reduction, material efficiency, and compliance with environmental legislation.

Key environmental benefits of remanufacturing include:

- Up to 85% of the original engine mass is conserved, according to the U.S. EPA. At Original Engines Co, on average, 65% of the existing engine core is salvaged and returned to service.

- Significant reductions in raw material consumption, including aluminum, steel, and copper.

- Up to 80% less energy used in remanufacturing compared to producing a new engine from raw materials.

For example, remanufacturing a typical diesel engine conserves approximately 1,500 lbs of steel and saves over 1,000 kWh of energy, as validated by the Automotive Parts Remanufacturers Association (APRA).

These environmental performance metrics not only support sustainability goals but also:

- Contribute to OEM and fleet carbon reporting

- Align with government decarbonisation targets

- Support ISO 14001 and related environmental certification frameworks

In an era where regulatory compliance and public perception are increasingly linked to sustainability credentials, remanufactured engines offer a strategic pathway to meet both operational needs and ESG commitments.

Still, Why Not Just Replace with a New Engine?

At first glance, replacing a failed engine with a brand-new unit may appear to be the ideal solution. However, in practice—especially for out-of-warranty vehicles or models beyond their production lifecycle—new engines are often not the most viable option.

Key Limitations of New Engine Replacement:

- Cost-Prohibitive: New engines can cost 30–50% more than their remanufactured counterparts, making them uneconomical for customer-pay, insurance-covered, or extended warranty repairs.

- Availability Constraints: For older or discontinued models, new engines are frequently out of production or suffer from long lead times, delaying service delivery and frustrating customers.

- OEM Inventory Prioritisation: OEMs commonly allocate new engines to vehicle production, not aftersales service. This limits dealership access and complicates service bay inventory planning.

- Material and Supply Chain Pressures: Manufacturing new engines requires substantial volumes of aluminium, steel, and rare metals, exposing OEMs and suppliers to price volatility and raw material shortages. In contrast, remanufacturing reclaims usable components, easing demand on critical material inputs and supporting supply chain resilience.

For these reasons, remanufactured engines are increasingly favoured by OEMs and dealers seeking a reliable, cost-effective, and sustainable solution that meets service quality expectations—without the inventory or economic challenges associated with new units.

Conclusion: Remanufacturing is a Choice for Long-Term Value

For OEMs and dealership service leaders, the engine replacement decision extends far beyond immediate cost—it touches on brand reputation, customer satisfaction, operational efficiency, and environmental compliance.

Remanufactured engines distinguish themselves through:

- OEM-level consistency and validated durability

- Comprehensive warranty coverage

- A significantly lower environmental footprint

- Strategic alignment with OEM aftersales and ESG priorities

While used or rebuilt engines may offer stopgap solutions in select cases, a structured remanufacturing program delivers the lowest total cost of ownership, minimal warranty risk, and the strongest customer retention outcomes over the vehicle lifecycle.

Why Original Engines Co?

At OEC, we engineer performance, reliability, and sustainability into every remanufactured engines. Our OEM-aligned processes, ISO-certified quality systems, and long-term partnerships with brands like Ford and Mazda position us as Australia’s leading engine remanufacturer.

From precision engineering to sustainability-driven practices, OEC empowers OEMs and dealerships to meet today’s service challenges while building tomorrow’s aftersales legacy.